Amid labor constraints that include talent shortages, rising wages, employee morale challenges, and health and safety issues, CHROs downgraded their rating of current business conditions in September but predict things will soon take a turn for the better. They rate their forecast for business by this time next year as “very good” on the hope that the effects of the pandemic will be behind us.

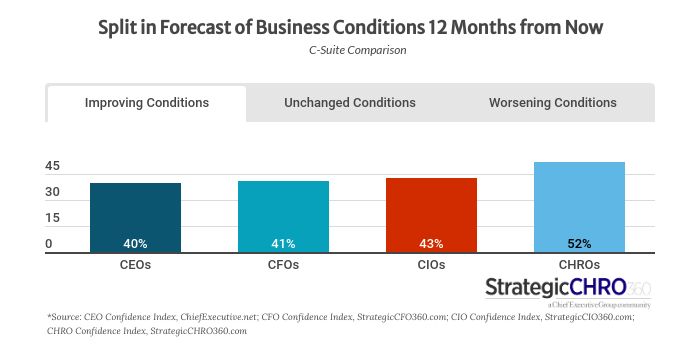

Those are the key findings of our CHRO Confidence Index, which shows 52 percent of senior HR executives projecting improving conditions for business over the next 12 months. In comparison, only 40 percent of CEOs, 41 percent of CFOs and 43 percent of CIOs agree. Even more telling of CHROs’ optimism is the fact that only 13 percent expect things to worsen, vs. 34 and 35 percent of CEOs and CFOs, respectively.

Our CHRO Confidence Index of Current Conditions is now at 7.1 out of 10 on our 10-point scale (where 10 is excellent), compared to 7.2 in August. That is down 3 percent from its peak in May. Confidence has been declining for CEOs and CFOs as well in recent months, as reported by our sister publications, Chief Executive and StrategicCFO360, but CHROs’ rating remains the highest of their peer group.

Our leading indicator, which assesses optimism when looking at conditions 12 months from now, returned a reading of 7.8 this month—up from 7.6 the month prior and back to its highest level on record since we began tracking CHRO sentiment at the beginning of the year. With 52 percent forecasting improving conditions ahead—and only 13 percent expecting things to worsen—CHROs are currently the most optimistic of the C-Suite.

Growing demand and the tampering of pandemic conditions are the main reasons driving CHRO optimism—although many say the forecast is contingent on the issues of supply and labor resolving in the near future. In the meantime, most cite record levels of demand, an improving telework environment, increasing vaccination rates and economic viability as reasons for their bullish outlook.

“We had the best new business quarter ever, so I remain cautiously optimistic that we will see more of the same,” says the CHRO of a large NY-based financial services company. “Supply chain issues remain, but our business is consulting, so that has little impact on our results.”

“We are doing more business than ever before, and we don’t see it slowing down in our industry,” says an HR COE leader also in the financial services sector in New York.

Elsewhere, the CHRO of a California-based retail organization says “consumer behavior is clearly driving up retail.” For that reason, he rates both current and future conditions as “excellent,” according to our scale.

In the nonprofit space, a talent chief says while conditions are at a 5 out of 10 today, she expects them to improve to a 7 by this time next year. “Optimistic that Covid will be under more control and key institutions like schools, etc. will be back allowing employees to get back to a routine,” she says.

In the energy sector, the CHRO of a large multinational says “tampering of pandemic conditions, global economic conditions improving, rising commodity prices” are the drivers of his 10/10 forecast for business in 2022.

“Record levels of demand for our services, improved ability to offer telehealth and remote work, collaborative partnerships within our industry area” are all reasons given by a chief performance officer at a healthcare organization for her 10/10 rating. As for her assessment of current conditions, which she rates an 8/10, she says: “Currently struggling to recruit staff at the entry levels and dealing with some burnout at all levels, which is the only reason for not rating current conditions as excellent.”

Another CHRO in the healthcare sector says: “Business conditions have bounced back, and we’re looking forward now. Despite the Covid mandate and resurgence, we are learning to work within the limitations of Covid and adapt, even improve. I’m being conservative, but I think one year from now things will be even better than they are today.”

“The demand for technology services and IT cost savings from businesses drive demand for our services,” says the CHRO of a digital consultancy.

The CHRO of a large wholesale distribution organization says his rating stems from the fact that “we are in an industry that has benefited from less travel and more investment in your home,” he says.

CHROs in manufacturing—both consumer and industrial—say pent-up demand is the impetus for their positive forecast, despite supply chain disruptions. One of the industry’s HR chiefs says: “Supply chain and labor issues are a concern today, but demand is very strong.” She expects conditions to improve, but says overall demand may also cool off, paving the way to some correction.

She’s not alone with that perspective. While forecasts are positive, some say they nevertheless anticipate volatility amid ongoing uncertainties. The EVP, Human Resources and Administration of a large transportation company, for instance, says, “The potential for tax law changes, inflation, uncertainty surrounding Covid, general labor shortages and supply chain issues” are all factors affecting his outlook—although he still expects business conditions to be “very good” by this time next year.

The Year Ahead

When forecasting for their business, 67 percent of CHROs say they plan to add to their workforce over the next 12 months—the highest level on record this year.

While an increasing number of companies are choosing to maintain status quo on their capital expenditures in the year ahead—33 percent this month vs. 23 percent in August—the majority (52 percent) say their company intends to increase capex in 2022.

Revenue and profit projections, however, faltered slightly in September: 11 percent of CHROs expect their company’s annual revenues to decrease in the coming year (vs. 6 percent in August), and 13 percent expect profits to also decrease (compared to 8 percent in August).

This means fewer are now forecasting increases in revenues (82 percent vs. 84 percent in August) and profitability (72 percent vs. 78 percent in August). Yet, when compared to the rest of the C-Suite, CHRO forecasts remain the most optimistic.

About the CHRO Confidence Index

The CHRO Confidence Index is a monthly pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 partners with SHRM (the Society for Human Resource Management) to ask participating CHROs about their top issues and challenges for the months ahead. The results are released the following week on StrategicCHRO360.com.