Even as many CEOs and CFOs report rising operating expenses and pressure on margins, a majority of U.S. companies are planning to expand their workforces in 2026, despite continued increases in healthcare expenses, compensation and training investments.

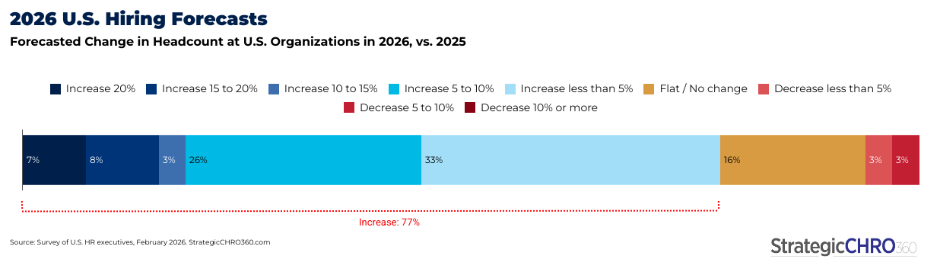

A StrategicCHRO360 survey of human resources executives conducted February 2–5 finds that 77 percent of HR leaders plan to increase headcount in 2026, reflecting a broadly expansionary outlook among employers. And while hiring plans remain modest—two-thirds say they anticipate increasing staff by less than 10 percent—fewer than 6 percent foresee reductions.

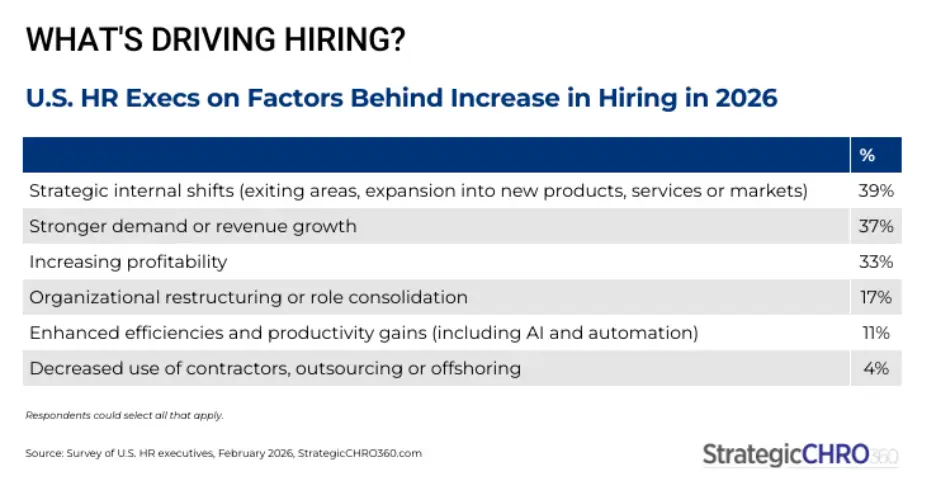

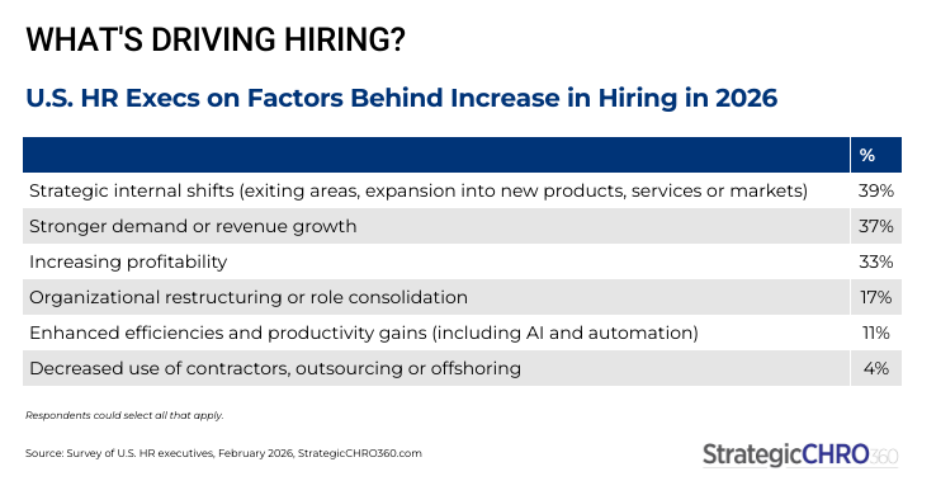

The reasons CHROs cite for hiring point primarily to internal strategic shifts rather than broad-based economic acceleration. Thirty-nine percent cite strategic repositioning—such as exiting certain areas or expanding into new products, services or markets—as a primary driver of hiring. Thirty-seven percent point to stronger demand or revenue growth, and 33 percent cite increasing profitability.

Restructuring, AI and Cost Pressures Temper Hiring

Among organizations that are laying off employees or holding headcount steady, the rationale differs. Among them: 95 percent cite organizational restructuring or role consolidation as a factor, followed by 70 percent who say AI-driven efficiency and productivity gains, particularly for those cutting staff, are a reason.

Then, there’s inflation. Fifty-five percent cite rising labor costs as a factor in freezing or reducing hiring.

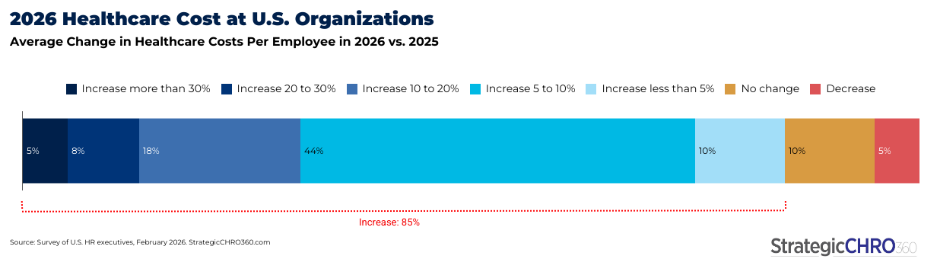

Healthcare expenses remain one of the largest operating cost categories for U.S. employers. Eighty-five percent of HR executives report higher healthcare costs per employee for 2026, continuing a multiyear pattern.

The findings align with recent research we conducted among CEOs and CFOs: 81 percent of CEOs forecast healthcare costs rising by up to 20 percent this year, compared with 80 percent of CFOs.

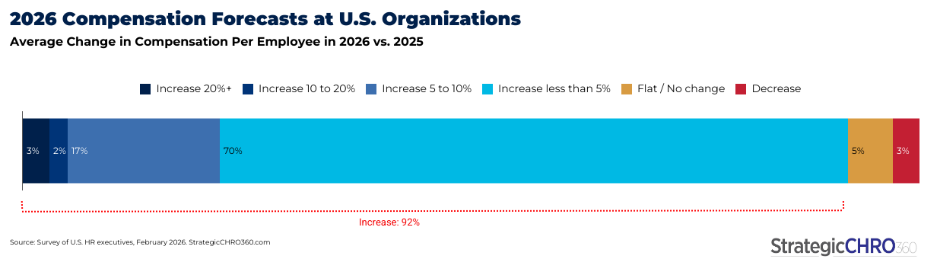

But healthcare isn’t the only labor-related cost on companies’ balance sheets. Compensation is also projected to increase in 2026 compared with 2025. Ninety-two percent of CHROs say their firm’s average compensation per employee would increase in 2026 compared with 2025, though nearly all say the increase would be limited to 10 percent.

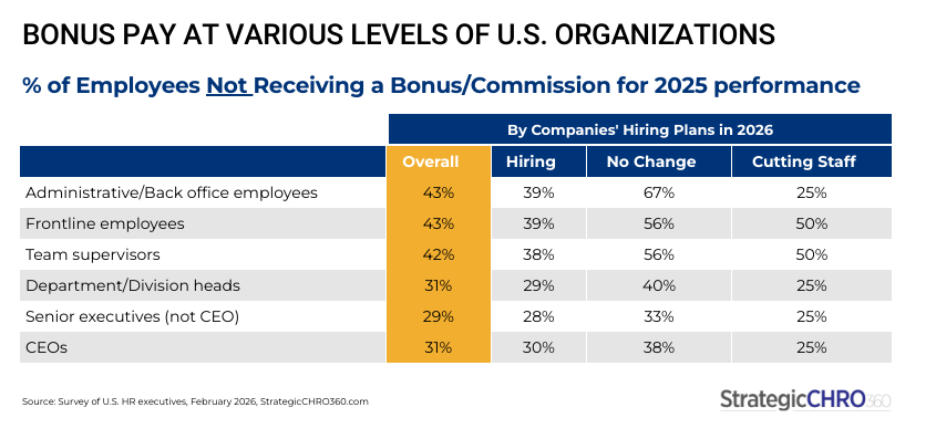

Incentive pay remains an important component of total compensation, though bonus eligibility for 2025 performance varies widely by role. Approximately 45 percent of HR executives polled say their company is not projecting a bonus payout to frontline and back-office employees and lower-level managers for their 2025 performance, while 31 percent of senior executives may not receive bonus compensation either.

Companies holding headcount steady report the highest proportion of employees not receiving bonuses. Sixty-seven percent of those planning to freeze hiring this year say they are not expecting to pay a bonus for 2025 performance to their administrative and back-office employees. That number falls to 40 percent among firms that are hiring this year and 25 percent among firms that are cutting headcount.

We observe a similar trend among frontline workers: Among companies holding headcount steady in 2026, 56 percent of frontline workers are not expected to receive bonus pay for 2025 performance, compared with 40 percent among companies hiring and 50 percent among those cutting staff.

The same trend continues across all organizational levels, though the delta thins with seniority.

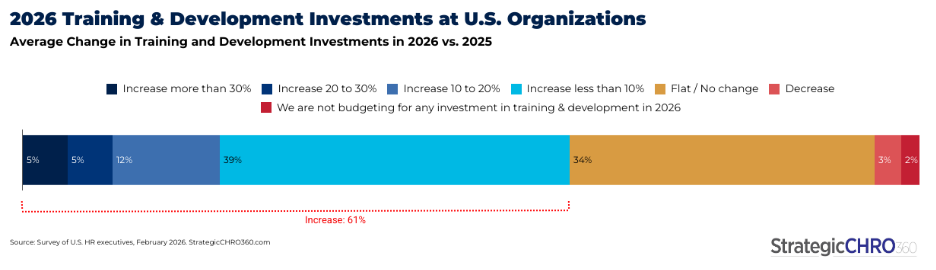

Alongside wages and healthcare, employers are channeling more resources into workforce development this year. Sixty-one percent of HR leaders say they plan to increase investment in training and development, with 51 percent expecting to boost spending by up to 20 percent.

Taken together, the findings depict employers expanding selectively while managing sustained cost pressures. Healthcare expenses are rising at rates that exceed base pay increases for most organizations, reinforcing their role as a central driver of labor costs. At the same time, investment in training and development suggests companies are preparing their workforces for continued restructuring and technological change.