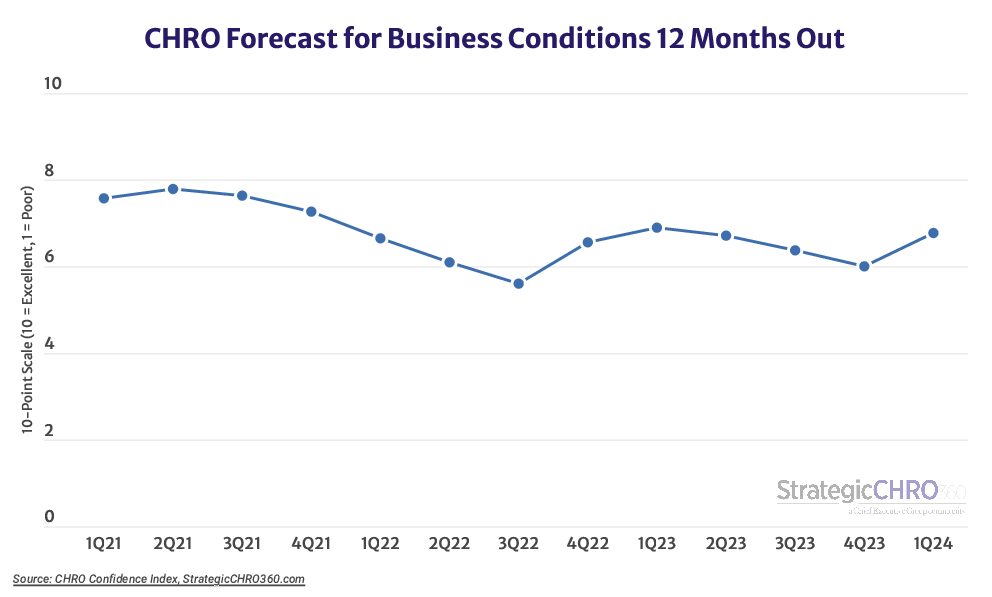

After months of declining confidence in business conditions throughout 2023, CHROs’ outlook for the next 12 months has finally improved in their first poll of 2024. Even amid a slew of challenges, from sticky inflation to high interest rates to a likely rocky presidential election on the horizon, CHROs are positive about the future, as were CEOs when we polled them in February.

The 126 qualifying senior HR executives who participated in StrategicCHRO360’s national poll in February rated their outlook for business conditions 12 months out at 6.8 out of 10, on a 10-point scale, where 1 is Poor and 10 is Excellent. This outlook is up over 10 percent from last quarter, and only 2 percent below their outlook in 1Q23.

CHROs’ rating of the current environment also shot up more than 10 percent, to 6.4 out of 10 this quarter, compared to only 5.8 out of 10 last quarter. Still their present rating is 5 percent lower than the same measure one year prior.

Although their overall ratings of both current and future conditions increased this quarter, there is still a marked hesitancy underlying CHROs’ optimism. The data shows that almost half (48 percent) of CHROs expect conditions in 12 months to remain unchanged from today, while only 38 percent expect conditions to improve. And although the proportion of CHROs who expect conditions to worsen over the course of the year is almost half that of CEOs (14 percent of CHROs vs 26 percent of CEOs), those forecasting improvement are still overshadowed (38 percent of CHROs vs 46 percent of CEOs).

“Recruiting a stable workforce is very challenging,” says Kathy Carmody, CHRO at Accomack County in Virginia. She expects conditions to deteriorate further, elaborating, “Home buying prices, interest rates and childcare costs make it all the more challenging to recruit. I am also concerned about the outcome of presidential elections.”

She’s not the only one who says that recruiting is still difficult, and echoes concerns of many others who have pre-election anxiety. Other HR leaders expect consumer spending to decrease as debt ratios climb while inflation and interest rates remain the same.

“There is political and market uncertainty, especially this year,” says Alisha Waring, VP of HR at U.S. Energy Development Corporation, and she also expects conditions to deteriorate.

Despite the shared anxieties of the group, the vast majority of CHROs polled expect conditions to remain unchanged or improve. They explain that economic indicators are strong, their companies are focused on growth and they expect that the economy won’t get much worse than it is now. Even if it does, they say their leadership teams have experience dealing with the punches of the last few years.

Shawn Fricke, CHRO of Albuquerque Health Care for the Homeless says, “We have a strong leadership team in place and have focused on making our culture one based on diversity, equity and inclusion (with concrete steps to ensure this, not just paying lip service to a trend),” explaining why he thinks business conditions will improve.

“Our approach to the market transcends economic variables,” says John Blake, CHRO at Vector Controls & Automation Group.

Gina Daley, director of benefits & employee relations at CTG, Inc., echoes Blake’s confidence when she says, “There is a focus on growth and expanding sales reach into different areas.”

The Year Ahead

CHROs’ forecasts for profit and revenues also climbed this quarter: +13 percent of CHROs forecast increases in profit over the coming 12 months and +20 percent forecast increases in revenues. Now, 68 and 81 percent of CHROs expect increases in profits and revenues over the next 12 months, compared to 65 and 72 percent of CEOs, respectively.

“Attendance and revenue are continually increasing since the pandemic,” says the CHRO at a more than $250 million museum.

In a change from last quarter, a lower proportion of CHROs expect increased turnover in the year ahead, at 34 percent compared to 43 percent last quarter. The proportion projecting rising wages also fell, to 85 percent from 86 percent the prior quarter, but the proportion projecting wage increases of 10 percent or more shot up from 7 percent last quarter to 16 percent this quarter.

Fully three-quarters of all CHROs surveyed plan to increase hiring over the coming 12 months, up from 66 percent last quarter; 56 percent of CEOs say the same. The proportion of CHROs planning to increase workforce investments also climbed this quarter, up 12 percent to 62 percent.

To receive more benchmarking data from the CHRO community, please make sure to subscribe to our quarterly CHRO Confidence Index. Participation is confidential, and respondents receive exclusive reports on these and other findings from peer studies. To subscribe, send an email to Research@ChiefExecutiveGroup.com.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.