For months, business leaders around the country have struggled, according to our C-level research, to find their footing, citing uncertainty across several planes as the primary reason: uncertainty about the Fed’s next move, uncertainty on the world scene, uncertainty in the White House, uncertainty in labor trends. The list goes on.

But a plurality of America’s CHROs are now optimistic that we will see improvement in the business landscape in 2025, putting an end to the uncertainty and fueling growth across industries.

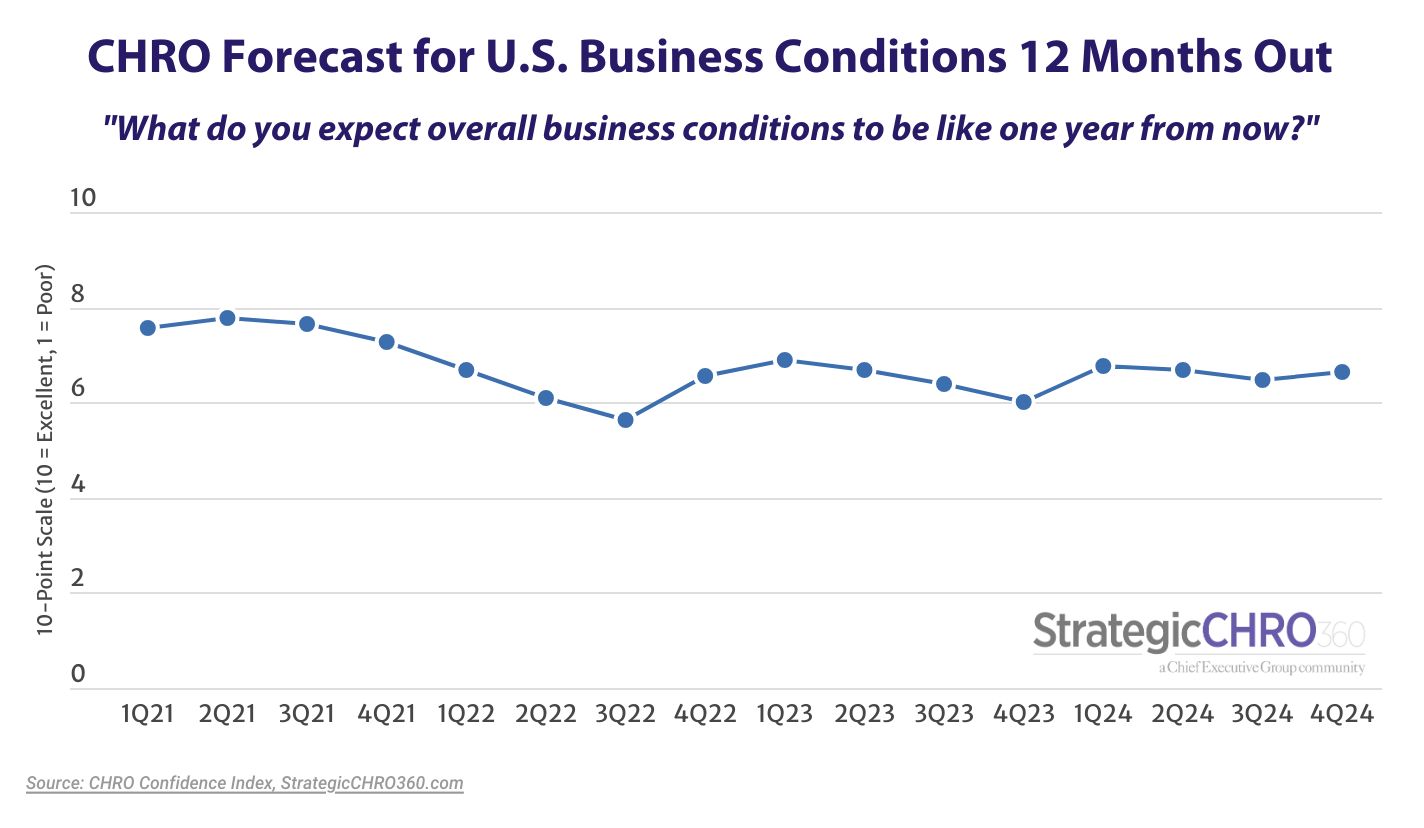

When asked to rate what they expect business conditions to look like 12 months from now, they gave an average rating of 6.7, on a 10-point scale where 1 is Poor and 10 is Excellent—up 6 percent from their 6.5 rating in August, when we last polled them for our Q3 CHRO Confidence Index.

When asked to explain their forecast, the expectation that the Fed’s continued easing will free up more capital, a softening labor market and a more stable post-election environment were among the most cited reasons.

Perhaps unsurprisingly, the U.S. presidential election was the most discussed among the 174 CHROs who participated in this quarter’s poll. For many, simply getting past November 6 and the rhetoric of the campaigns will provide enough of a tailwind to businesses.

“The talk of recession and the election has impacted buying habits. I think 2025 will move us away from this,” said the CHRO at a PE-backed company in the restaurant industry.

“The uncertainty around regulatory climate should settle post-election,” added the CHRO at a mid-sized professional services firm.

Still, several said the outcome of the election is just as important when forecasting the year ahead.

“Change is needed to make a more friendly business climate,” said one CHRO at a mid-sized construction company.

“If Trump gets in….. I think the economy will soar… if Kamala gets in, I’m not so sure,” said a CHRO in the travel and leisure sector, where CHROs’ 12-month forecast for business is 23 percent higher than the cross-sector average, at 8.2 out of 10—the highest of all industries represented by our survey.

For the CHRO of a large public healthcare company, a different outcome would be better suited to the healthcare industry: “Healthcare funding and insurance generally does better under a Democratic administration.” CHROs polled in that sector gave an average forecast of 6.9/10 for business conditions 12 months from now, 4 percent higher than the cross-sector average.

At the end of the day, said the CHRO of a large public company in the financial sector—where the average CHRO forecast for 2025 is 6.3, 6 percent lower than the cross-sector average—“if there is a sense of renewed optimism in the country, business conditions will continue to improve.”

And for now, there is hope—at least among CHROs polled. Our Q4 survey found an increasing proportion of HR chiefs betting on improvements in the business landscape in 2025: 40 percent vs. 35 percent who said the same in Q3—an increase of 14 percent.

As for how the election will play out in the workplace, CHROs aren’t too concerned. More than three-quarters (77 percent) said they haven’t observed any uptick in conflicts among employees or tears in the corporate culture fabric at their respective companies as a result of what many view as divisive rhetoric.

“We operate in 10 states, a combo of red and blue states. As a very liberal company with a high population of conservative employees, this has not been an issue in the workplace,” said one CHRO.

For others, the key is getting ahead of the situation.

“We experienced [conflict] in the 2020 election and have been proactive on communication about it this year,” explained one respondent.

“We have been proactive in getting in front of our colleagues to offer training and support for civil discussions in the workplace,” echoed another.

Some CHROs said their approach is the same when addressing the wars in the Middle East and Ukraine, where potential conflicts needed to be managed proactively, with a focus on respect and civility.

Company Snapshot

CHROs’ overall optimism for improvements in the business landscape in 2025 is reflected in their forecast for their respective companies as well: 69 percent said their company’s revenues will be up by this time next year—vs. 59 percent who said the same when we asked them in August—and 60 percent said profits would also increase—vs. 50 percent in Q3.

When it comes to talent specifically, the easing of the labor market appears to be paying dividends: 72 percent of CHROs now expect wages to continue to rise through 2025, down from a proportion of 78 percent who said the same when asked in Q3, and 48 percent said they expect to increase their workforce investments (excluding compensation), up from 39 percent in Q3.

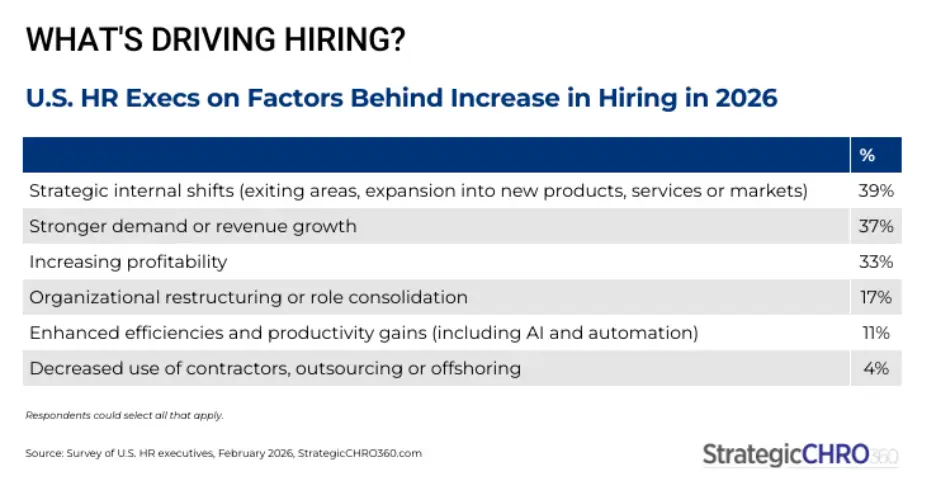

Hiring is also picking up: 69 percent plan to increase hiring in the year ahead—up from 56 percent last quarter—though 38 percent say they expect turnover to increase, up from 31 percent in Q3.

This quarter, we also asked CHROs about the impact of RTO mandates on their workforce, the benefits that work best to attract and retain employees and the pros and cons of pay transparency. We will publish the aggregated results over the coming weeks. Keep an eye on StrategicCHRO360’s weekly newsletter for more details. If you don’t receive the newsletter, you can sign up here.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.