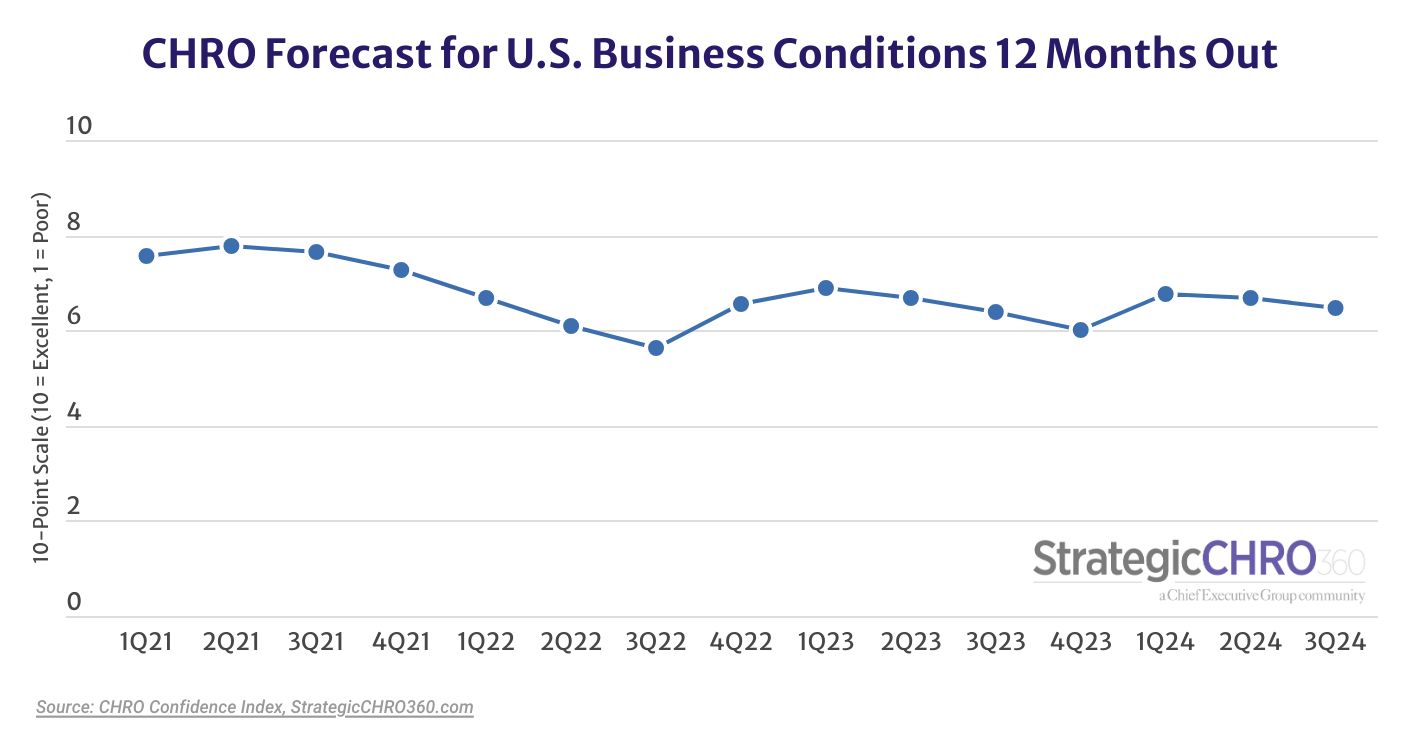

CHROs retained their spot as the most pessimistic members of the C-Suite in 2024, with a greater proportion of HR chiefs forecasting declining business conditions in the months ahead compared to CEOs, CFOs and board members.

The proportion of CHROs forecasting improvements in business conditions in the U.S. declined double digits in StrategicCHRO360’s third-quarter CHRO Confidence Index polling during the week of August 19—from 39 percent in Q2 to 35 percent in Q3.

In contrast, 46 percent of CEOs and 40 percent of CFOs expect the business landscape to improve over the coming months—and 42 percent of board members feel the same.

When asked to rate business conditions 12 months from now on a scale where 1 is Poor and 10 is Excellent, the CHROs polled in August gave an average of 6.5—a downgrade from the 6.7/10 rating they gave in Q2.

“It will take time to recover from the extraordinary inflation that has impacted cost of living for middle class and below,” said one of the CHROs participating in the survey.

Others are referencing slowing trends in their respective industries:

“Our customers are mostly from home improvement and construction sectors. High interest rates, low rates of home sales/people moving, and people being careful with their money has slowed down that industry and, therefore, our customers,” explained one CHRO.

Across sectors, several other CHROs noted declining demand. And for most respondents, whether this worsens or improves depends on who wins the White House in November.

“U.S. POTUS election is a big unknown but will drive business conditions dramatically,” said one participant, echoing others.

The uncertainty is dragging CHRO optimism down, with an increasing proportion forecasting worsening conditions over the next 12 months: 20 percent, vs. 15 percent in Q2.

Company Snapshot

Slowing demand, increasing wages and political uncertainty are, CHROs report, affecting corporate outlooks. Nearly 20 percent fewer CHROs now expect their respective companies to post higher revenues by this time next year, from 73 percent of CHROs in Q2 to 59 percent in Q3.

That is the lowest proportion on record since we began polling CHROs on these issues in January 2021. The only time CHROs have been so few in forecasting increasing revenue was in the third quarter of 2022, amid labor shortages brought about by the Great Resignation, ongoing supply chain delays and mounting inflationary pressures.

The data shows a similar trend when it comes to profitability, with 50 percent of CHROs saying they expect their companies to have higher profits 12 months from now, down 17 percent from 60 percent in Q2. This is the second lowest level since the survey’s inception, only surpassed by, again, the third quarter of 2022.

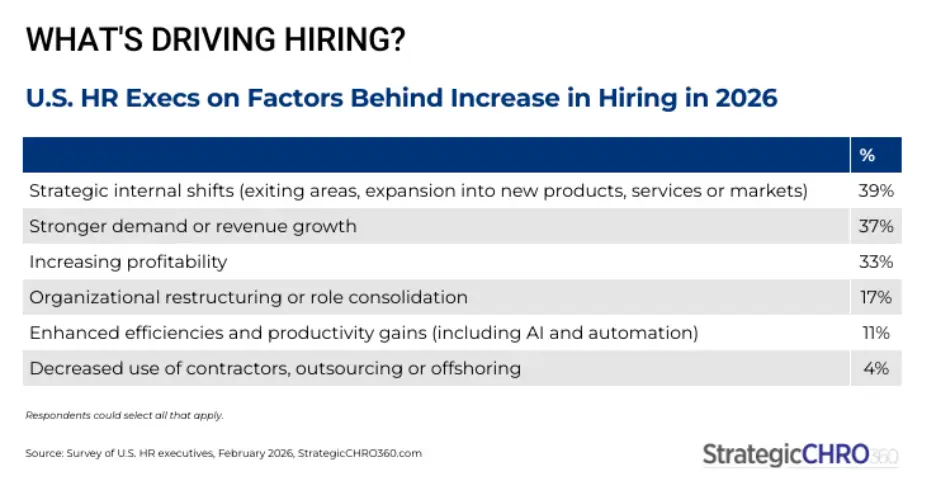

The impact, as one can expect, is affecting workforce-related investments. Only 39 percent of CHROs polled in August said their companies are expected to increase their investment in labor (excluding wages), down from 55 percent in Q2—a decline of 29 percent. That is by far the lowest level on record since the inception of the CHRO Confidence Index nearly four years ago.

The good news, perhaps, is that less than 10 percent are expecting cuts in those investments. Instead, the majority are simply keeping with the status quo for the foreseeable future.

Most CHROs (78 percent) say wages are expected to continue to increase into 2025, as they note that providing competitive compensation drives the most value for companies when recruiting and retaining talent.

And while 65 percent of CHROs say they have seen an improvement in their hiring outcomes so far since the labor market has begun cooling, only 56 percent say they intend to add to their company’s headcount in the next 12 months—down 15 percent from 66 percent in Q2.

This quarter, we also asked CHROs about their priorities for the year ahead, their intended work model and their AI tool recommendations for HR. Keep an eye on StrategicCHRO360’s weekly newsletter for more details. If you don’t receive the newsletter, you can sign up here.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.