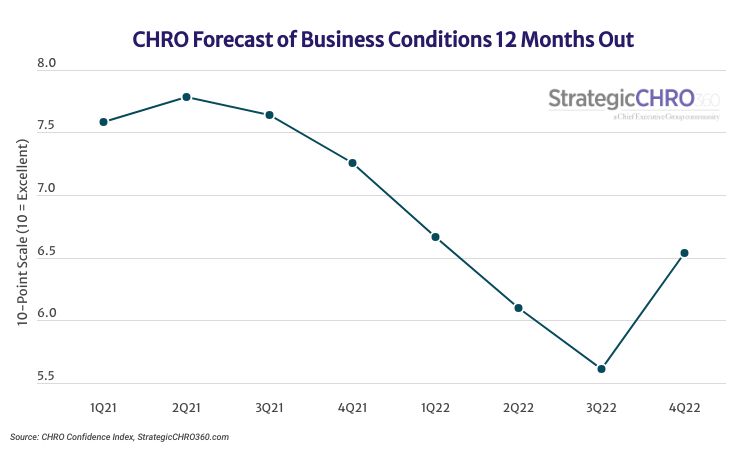

With inflation dipping below 8 percent for the first time since February, CHROs are hopeful that strong demand will continue, rating business conditions one year from now a 6.5 out of 10, up double digits from Q3, in StrategicCHRO360’s Q4 CHRO Talent Index.

Heads of HR have also grown more satisfied with current business conditions, ranking them a 6.7 out of 10 when StrategicCHRO360 surveyed 120 CHROs on November 14-17. This rating is up 17 percent since last quarter. CHROs have regained their position as the most optimistic of the C-Suite, outranking CFOs and CEOs on both measures.

Diminishing inflation is fueling both their sentiment for current conditions and their outlook, along with increased travel and in-person business. However, many forecast that conditions will worsen due to broad layoffs in certain sectors, like tech, which could lead to higher unemployment, reduced consumer spending and persistent supply chain issues.

Samuel Cueva, VP of human resources at Dimension Hospitality, is encouraged that business conditions will improve from his 8/10 ranking today to 9/10 one year down the line due to “increased business travel and convention business.”

Petrina Gooch, principal, corporate HR Leader at HED, a professional services firm, shares Cueva’s rating and says, “The market sectors we serve and the type of work we do, which is architecture and engineering, are holding steady and positive.”

Some CHROs highlight an increasing connection with their leadership team as the reason for their optimism.

The VP of HR from a $100 million to $249.9 million construction firm says, “Leadership’s involvement in improving our culture, improving communication, identifying root causes of employee discontent, low morale and disengagement, and addressing the issues from low hanging fruit to major paradigm shifts is fueling my outlook for change.” He ranks current conditions as 8/10 and expects them to climb to a perfect score in 12 months.

“Alignment of leadership and better storytelling for our employees is keeping my outlook optimistic,” says the VP of people services at a large construction firm who expects conditions in the future to rank 9/10.

Although CHROs’ rating climbed in November, the 35 percent who are forecasting worsening conditions remains unchanged from the prior polling in August. But CHROs are not necessarily pessimistic either; the proportion forecasting worsening conditions is the smallest of the C-Suite—compared to 43 percent of CEOs and 45 percent of CFOs polled earlier this quarter.

Hesitant CHROs point to challenges doing business, from costs to recruitment, that they say still haven’t eased. Some couple those concerns with a looming recession, supply chain issues, broad layoffs and global political instability, in expecting that conditions will deteriorate.

“Costs growing faster than revenue and we are unable to optimize staffing,” says the CHRO of a large healthcare provider, who expects business conditions to deteriorate down from 5/10 today to 4/10 by 4Q23. “We seem to be experiencing an unexpected increase in the fragility of our workforce mental health,” she adds.

“Pending layoffs of our customers, labor challenges and supply chain issues,” lists the VP of HR at a large construction/engineering firm to explain her 5/10 rating of future conditions, down from 6/10 today.

The Year Ahead

The proportion of CHROs forecasting increases in profits and revenues climbed for the first time since 1Q22, up 25 and 14 percent, respectively. In Q4 of this year, 57 percent of CHROs expect profits to climb over the next 12 months while 67 percent expect the same for revenues. Both figures are in alignment with CEOs, 56 percent of whom projected increasing profits and 65 percent of whom projected increasing revenues when polled earlier this month.

The proportion of CHROs planning to add to their headcount over the next 12 months jumped 15 percent in Q4, now at 69 percent. This is the first increase in one year and the highest proportion of the C-Suite forecasting additional hiring.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.