StrategicCHRO360’s quarterly index, conducted in partnership with the Society for Human Resource Management (SHRM), finds a quarter (24 percent) of U.S. senior HR executives view the current environment as “weak” or “poor” for business, on a 10-point scale.

When asked to forecast the environment they expect one year from now, that proportion increased three percentage points, to 27 percent. Overall, 35 percent of the CHROs polled during the week of August 22 say they now expect things to deteriorate further in the months ahead.

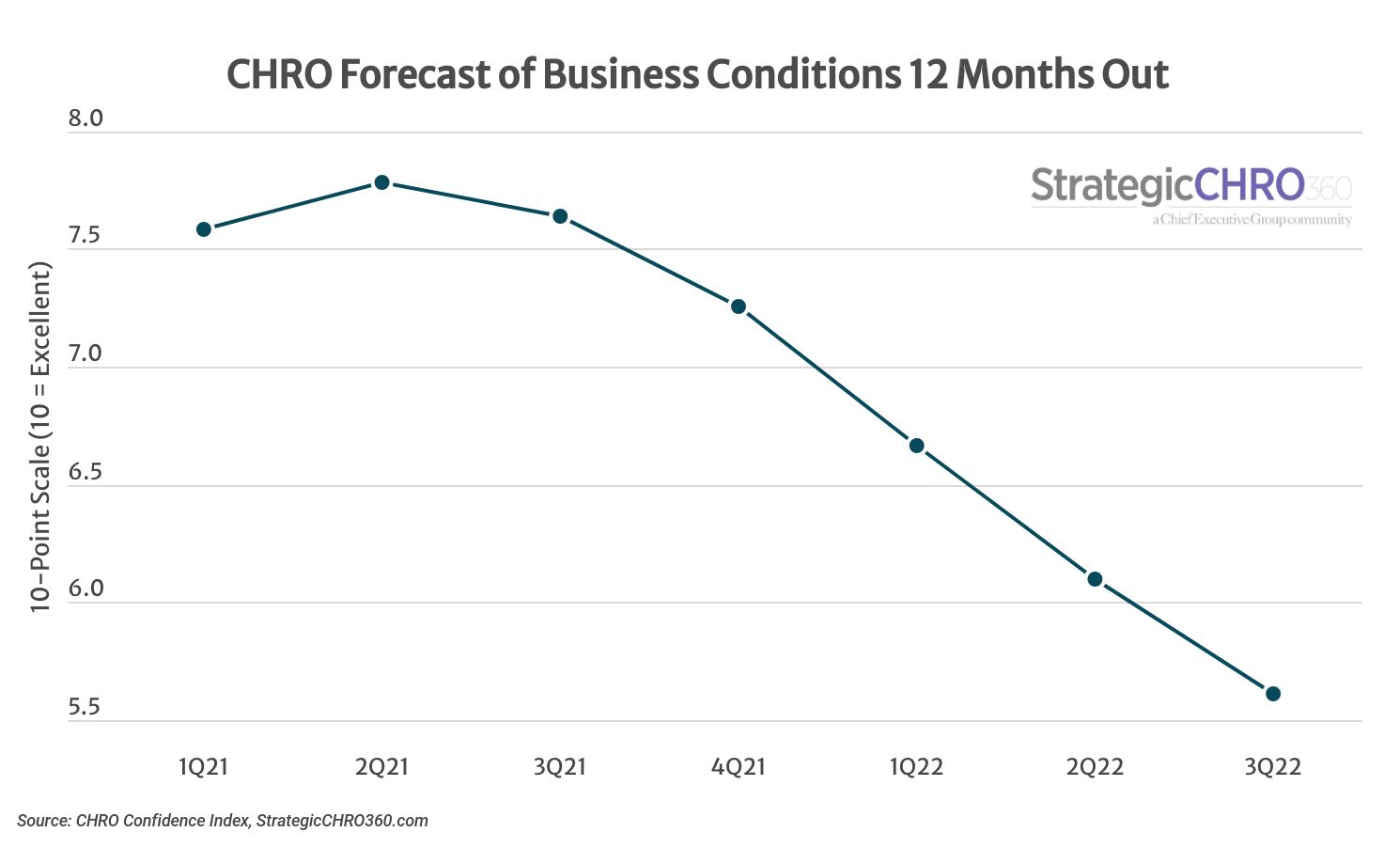

According to our leading indicator, CHROs anticipate conditions to rank at 5.6 out of 10 by this time next year, down from their rating of 5.7 today. Both of those numbers are down nearly double digits from the previous quarter, since we last polled them on this matter.

“Current headwinds, based on inflationary pressures, are impacting consumer spending and the overall bottom line,” said the EVP of HR of a large public health services company who expects a recession by year end. “[We’re] taking steps to mitigate the economic impact by thoughtful budget planning and focusing on key strategic investments that we believe will put us in a better position in 12 months.”

“Anticipating clients having less disposable income, which means they will cut back and down on spending and evaluate needs vs wants,” said the CHRO of a multinational conglomerate, who forecasts business conditions to fall from a 6/10 today to a 4/10 by this time next year.

“People are fearing a recession and beginning to act with more caution as a result,” said the CHRO of a small professional services firm in New Jersey.

“Supply chain and inflation issues are not resolving, which means we are in this recession for a bit,” said the CHRO of a PE-backed IT company. “I don’t see improvement on the horizon.”

The Issue of Labor

CHROs would have to be living under a rock to not consider inflation and the probability of a recession—or at least a slowdown—in their forecast for business, and fully one-quarter of those surveyed did forecast a slowdown in the economy over the next 3 to 6 months—and 26 percent said they expect a recession.

Yet, despite this projection—which is in line with that of CEOs when we polled them earlier in the month—most HR chiefs say labor remains the primary issue for the company, with 71 percent saying current shortages bear the greatest influence on their organization’s practices over the next 12 months.

“Employee turnover rates are higher than in the past. This is expensive and not something the organization has priced in or evaluated from a budget standpoint,” said the CHRO of a Nevada-based nonprofit.

“The employee experience and the pay scales have to change to meet the needs of the current workforce. If it does not, industries will continue to find themselves short-handed and quality of service will remain low,” said the VP of HR at a publicly listed company who struggles with staff retention.

“If we can manage the labor issue, our business and industry will be fine,” said the HR director of a mid-sized industrial manufacturer.

“Our organization usually does well under any conditions, but the cost of goods and cost of employees is extremely high, and I would expect our earnings to suffer because of it,” said the HR director of a small financial services firm in Minnesota.

For those reasons, 84 percent of CHROs polled say they’ve shifted their human capital strategy to give greater priority to employee engagement and retention, followed by talent acquisition (72 percent). Relinquished to the bottom of the list, at least for now, are HR technology management and innovation (10 percent) and CSR (6 percent).

Against this backdrop, the proportion who plan to add to their workforce in the year ahead declined 13 percent, from 70 percent when we last polled them in May to 61 percent in August. Of the 16 percent who expect to have a reduced workforce by this time next year, the majority say they simply have no plans to replace employees who have left or will be leaving.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 partners with SHRM (the Society for Human Resource Management) to ask participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.