Last week’s market rally and rising CEO optimism may signal strength for U.S. businesses, but CHROs are using caution in their forecast, as the U.S. presidential election nears.

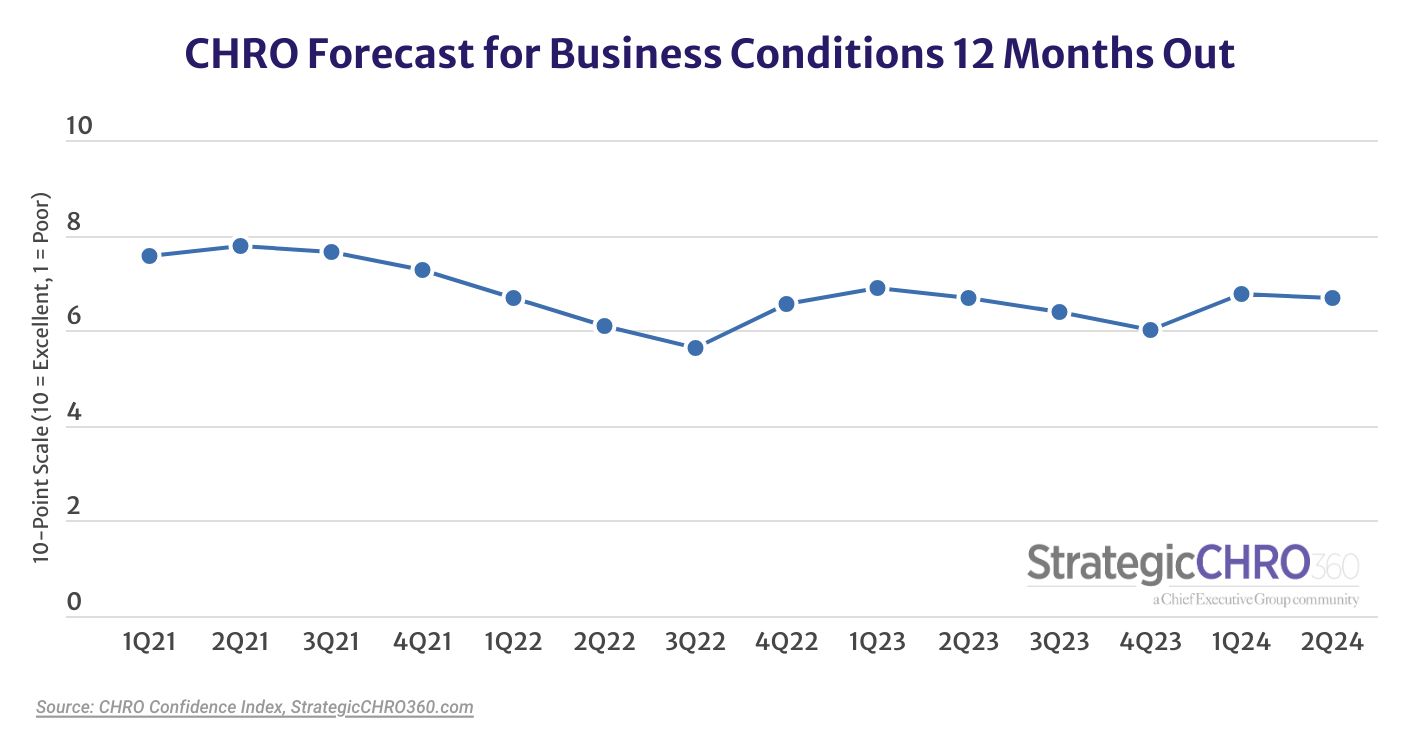

After jumping 13 percent at the start of the year, CHROs’ forecast for business 12 months out dipped slightly in the second quarter, shedding 1.5 percent from its one-year high in Q1, to 6.7 (on a scale of 1-10, where 1 is “Poor” and 10 is “Excellent”).

Still, at that level, our leading indicator remains well above its second-half readings of 2023 and is in line with where it was at this time last year.

But, CHROs say, despite the recent slew of positive economic data, that buoyancy could turn any moment, particularly as politics intensify—a situation one CHRO dubbed “Optimism with no evidence.”

“2024 election is a wild card,” commented one CHRO participating in the poll who expects conditions to tick up post-election, depending on who wins.

Hiring is also proving difficult, despite signs that the labor market is tightening.

“I just returned from an industry event, and the global feedback is very similar: Lack of hiring has greatly affected our industry,” said a CHRO at a small professional services firm.

“It costs more to employ American workers due to inflation and what large corporations are able to pay,” added a CHRO in the healthcare sector. “And the U.S. government hasn’t increased healthcare fee schedules, so it makes it virtually impossible to keep American workers employed in the U.S. healthcare industry.”

Those factors, combined with world events, are the reasons why 45 percent of the CHROs we polled are tapering their forecasts for the year ahead, betting on the idea that business conditions will be about the same by this time in 2025.

The numbers are fairly unchanged from what we found in our Q1 polling earlier this year, but they contrast with what CEOs told sister publication Chief Executive last week, when we asked them the same question: 49 percent said they expect conditions to improve over the coming year—and 29 percent expect them to stay the same.

The Year Ahead

Against this backdrop, CHROs’ forecasts for revenue and profit growth dimmed in Q2: 73 percent expect revenues to increase over the next 12 months—down 8 points from 81 percent in Q1—and 60 percent said the same about profits—down 11 percent from 68 percent in Q1.

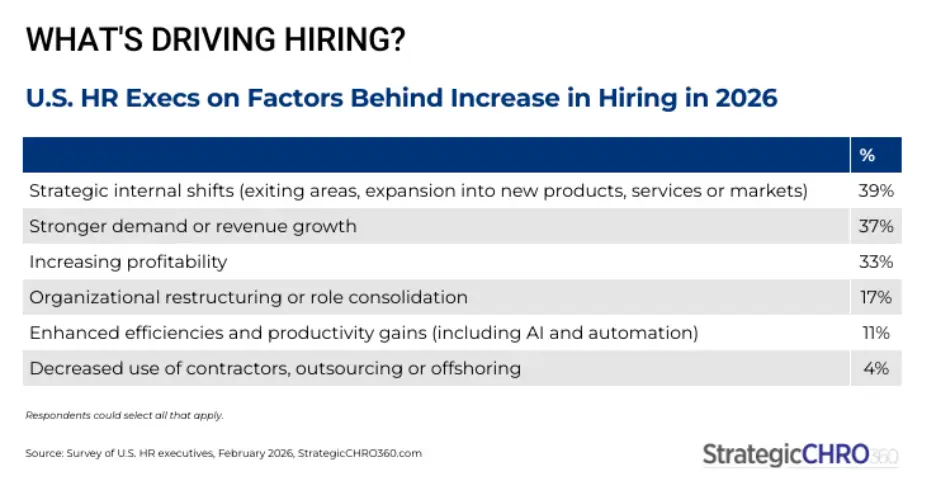

Similarly, the proportion of CHROs expecting to increase hiring and other workforce-related investments (such as L&D programs) declined by double digits, –12 percent each, to 66 and 55 percent, respectively, back to the levels found in Q4 of last year. Instead, 23 percent said they would keep hiring the same, and 39 percent said they would keep other workforce investments unchanged.

Good news for workers (maybe) is that 79 percent of CHROs plan to increase wages in the coming year—though it comes with a caveat: That proportion is down from 85 percent in Q1, and most of those planning to implement raises said the increases would be less than 10 percent.

And good news for employers (maybe): only 30 percent of CHROs forecast increases in turnover in the year ahead, down from 34 percent in Q1. But that doesn’t mean turnover will decrease, according to those polled. Instead, 39 percent said they expect turnover to be about the same, up from 30 percent last quarter.

Stay tuned for part 2 of the results, where CHROs discuss their company’s mental health programs—and the overall mental well-being of their workforce.

To receive more benchmarking data from the CHRO community, make sure to subscribe to our quarterly CHRO Confidence Index. Participation is confidential, and respondents receive exclusive reports on these and other findings from peer studies. To subscribe, send an email to Research@ChiefExecutiveGroup.com.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.