It probably doesn’t come as a surprise to anyone that optimism among business leaders in the U.S. is on the decline. Sister publication Chief Executive’s monthly poll of CEOs the first week of October showed a growing proportion bracing for a recession in the near term.

Similarly, a near majority of board members, polled by Corporate Board Member, are forecasting deteriorating business conditions in 2024—with only a quarter of the 250 surveyed saying they expect improvements in the economy.

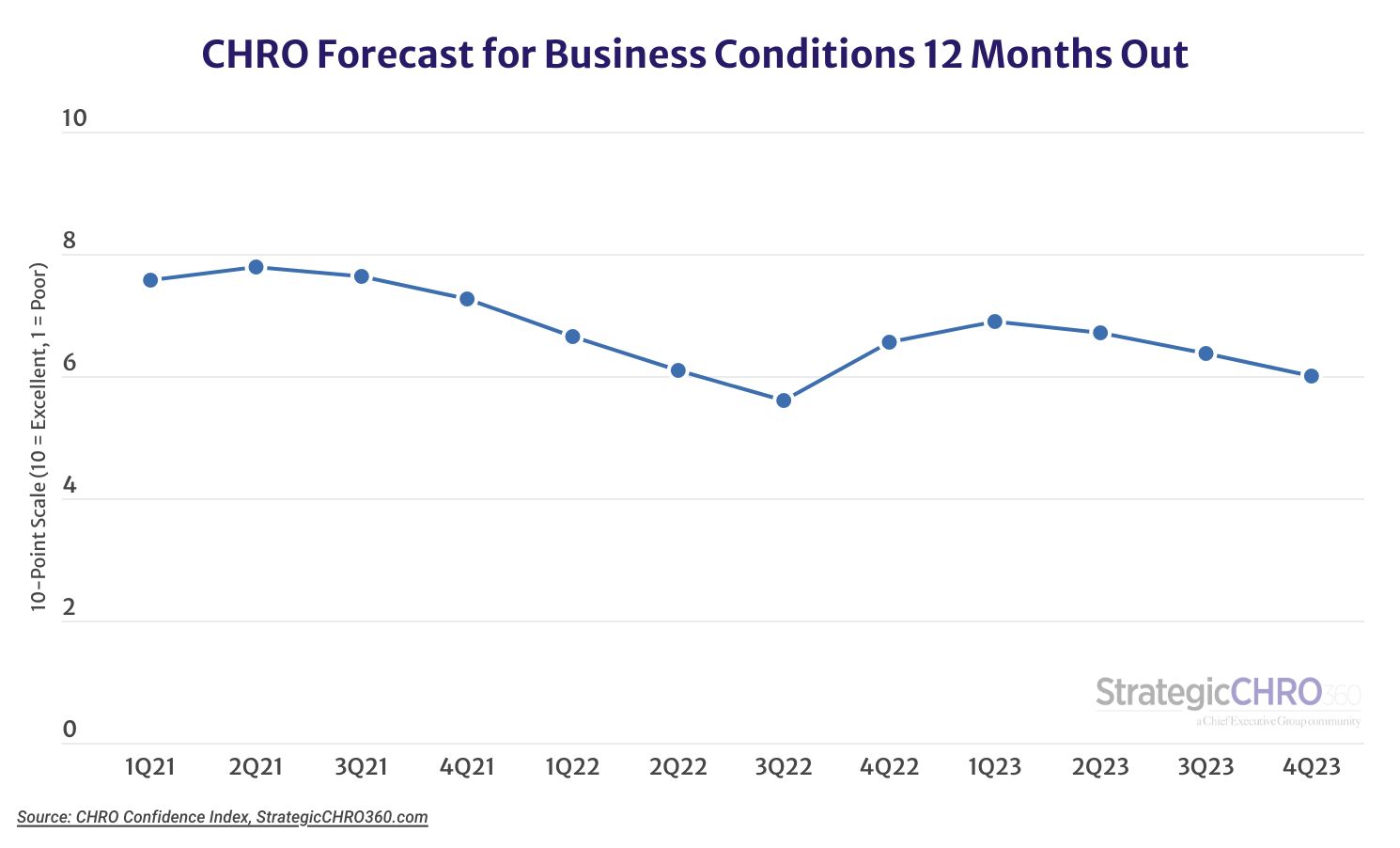

And last week, StrategicCHRO360’s Q4 CHRO Confidence Index, conducted among 126 qualifying senior HR executives across the country, found a similar trend: optimism is waning.

When asked to assign a rating on a 10-point scale, where 1 is Poor and 10 is Excellent, to the business environment they expect to see by this time next year, participating CHROs gave it an average of 6.0—6 percent lower than in Q3 and the second lowest level on record after Q3 2022 (5.6/10).

The reasons for a gloomier forecast are what you’d expect from almost anyone running a business these days: a still-tight labor market, stubborn economic pressures, high operating costs, geopolitical turmoil and a presidential election—not to mention continued volatility and uncertainty in the markets.

Much like their C-Suite counterparts, CHROs had hoped, last quarter, that conditions were on the mend in the U.S., but the proportion of CHROs expecting a recovery in 2024 has now dropped 9 percent, compared to August—from 43 percent to 39 percent—while the proportion expecting things to get worse in the year ahead grew 36 percent, from 16 percent in Q3 to 22 percent in Q4.

CHROs’ rating of current business conditions also fell this quarter, to 5.8 from 5.9 in Q3—a decrease of about 2 percent. That measure is now down 14 percent since the beginning of the year.

A Sector Play

Of course, the industry in which you operate has great influence on these ratings.

CHROs in the construction and energy industries bucked the trend by significant margins, rating their outlook for business by this time next year 31 and 30 percent above the average, respectively, at 7.9/10 and 7.8/10. They say they see valuable growth opportunities and strong demand for the months ahead.

Professional services CHROs also reported an above-average forecast for business, at 6.6/10—10 percent above the average of 6.0.

At the other end of the scale, financial services, healthcare and wholesale/distribution CHROs all forecast a gloomier-than-average landscape for business by this time next year—18, 15 and 14 percent below the average with ratings of 4.9, 5.1 and 5.2 respectively.

Those CHROs say wage pressures, mounting regulation, declining consumer sentiment, supply chain challenges and the ongoing challenge of finding qualified and affordable talent are all adding to the negative rating.

The Year Ahead

Yet, all of that is not enough to deter CHROs from expecting their respective companies to navigate the challenges with success. Overall, 67 and 63 percent of those polled said they expect their companies to post increasing revenue and profit growth, respectively, by this time next year—compared to the year prior. Those numbers are up from 61 and 51 percent in Q3.

This, of course, won’t be without challenges. Nearly half said they expect increased turnover in the months ahead, and 86 percent said they also expect average wages to increase over that same period—though almost all of them said that increase would be less than 10 percent.

To counter the effect of turnover and help their company to enhanced growth, 66 percent said they plan to increase hiring in 2024—up from 59 percent in Q3—and 56 percent also plan to boost their overall investments into their workforce (defined as L&D, well–being and similar offerings, excluding compensation)—up from 52 percent in Q3.

To receive more benchmarking data from the CHRO community, please make sure to subscribe to our quarterly CHRO Confidence Index. Participation is confidential, and respondents receive exclusive reports on these and other findings from peer studies. To subscribe, send an email to Research@ChiefExecutiveGroup.com.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 asks participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.