The talent landscape has changed in recent years—drastically. The Covid-19 pandemic was certainly a catalyst for the disruption we’ve experienced in the way we work, but even today, nearly five years out, America’s business leaders say labor remains one of their top challenges and biggest impediment to growth.

But even as CEOs rank “retaining and engaging employees” their #1 priority year after year (ahead of profit or revenue growth, no less) and CHROs place “developing and upskilling employees” and “finding & retaining qualified and engaged employees” at the top two of their priorities list for 2025, America’s HR chiefs say despite all the upheaval in labor dynamics, there’s still one aspect of the tried-and-true traditional talent strategy that still rings true today: Compensation matters.

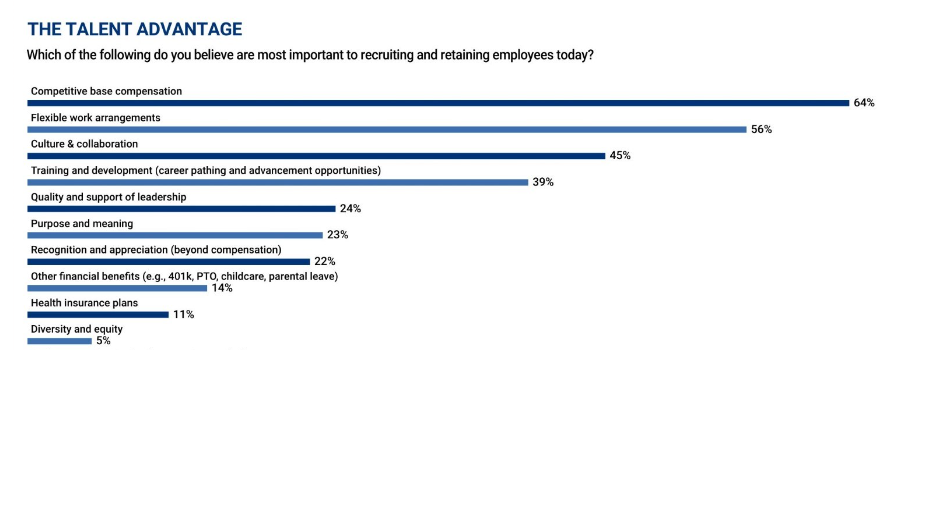

According to our poll of 174 U.S. CHROs during the week of October 14, the ability to provide competitive base compensation ranks at the top of the list of aspects most important to recruiting and retaining employees today—ahead of flexible work and culture. Even ahead of safety and well-being—by a large margin.

One way to interpret this finding could be to say that employers with the right pay scale have the “luxury” to skimp on a few other things, like remote work or DEI initiatives. But some CHROs polled say, not so fast.

“Would I give up diversity and equity for competitive base pay? No, not really, they are both important. Would I give up training and development for purpose and meaning? No… And PTO is at the top of my list [because] these are all important,” said the CHRO of a large public company in California who participated in the survey.

While the concept of ticking all these boxes does sound appealing, the data clearly shows that pay plays a big role in the recruiting/retention equation. So much so that fully two-thirds of CHROs say their company has implemented pay transparency—the disclosure of pay ranges or scales for the different roles inside an organization—and nearly half say they did so “by choice,” not because of legal requirements that some states such as California, New York and Connecticut now have.

Another 17 percent of CHROs polled say that while they’ve haven’t implemented these programs yet, they’re working on it. Only 16 percent gave a categorial no to that question, with one CHRO clarifying: “We are not posting or sharing salary ranges now and have no plans to do so.”

While the majority say that pay transparency is a positive practice that helps companies promote equity and compete to attract employee, opinions on its effectiveness are divided, even for those who have implemented such programs.

“We have discovered that transparency has led to a lot of internal, unproductive chatter that managers are not prepared to manage and at times exacerbate the challenges with employees,” said one CHRO.

The biggest challenge, some CHROs say, is accuracy and judgment. “There are often legitimate reasons for pay differences at the same level, and not all employees understand that,” wrote one CHRO.

Others mentioned that some companies communicate pay scales that are far from reality once the candidate walks through the door. And, of course, there is the unfortunate conundrum of those companies that do not have competitive comp plans to promote in the first place.

“If you are unable to outcompete others in the labor market for base pay or in specific insurance or other financial benefits or in learning and development, then pay transparency does a company no good,” said one of the participants in the survey.

And that appears to be a common issue, according to the survey respondents. When asked to rate their companies’ competitiveness when it comes to compensation, only slightly more than a quarter (29 percent) of CHROs said their company ranked above average compared to peers. In fact, compensation ranked second-to-last on the list of issues CHROs were asked to rank, only ahead of technology (by less than 1 percent) and L&D programs.

Taking these data points into consideration, along with the fact that half of the CHROs whose companies had mandated a return to the office—or at least some reduction in the flexibility of work arrangements such as ordering in-office days—said employee morale had decreased compared to pre-RTO, companies that want to retain the talent they have and attract top performers may need to rethink their strategy.

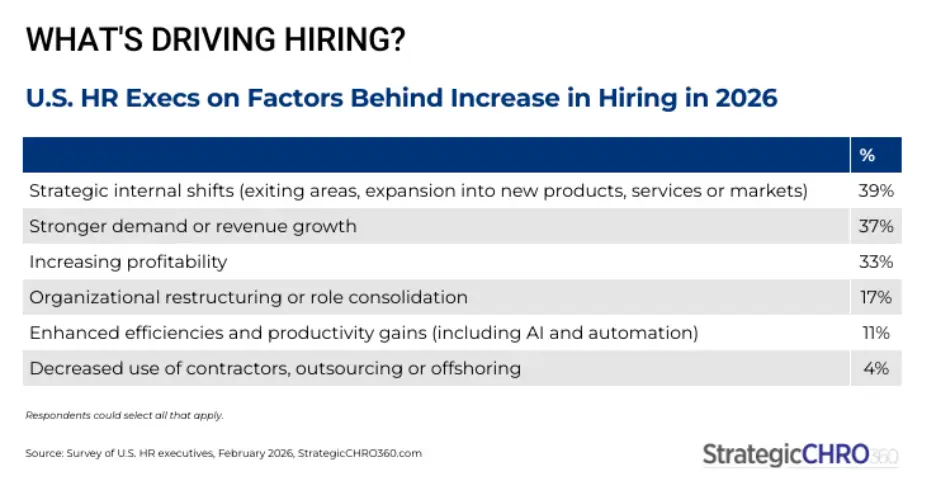

According to our most recent data, 69 percent of CHROs plan to increase hiring in the year ahead, up from 56 percent last quarter, but 38 percent say they expect turnover to also increase, up from 31 percent in Q3. Knowing this, counting on the easing of the labor market may not be enough and organizations may want to revisit the comp plan and work arrangements to ensure they are still competitive relative to peers.

For more information, Chief Executive Group (our parent company) has created a new Compensation Trends report to bring you exclusive pay data from more than 1,600 private companies across the country. The 2025 report will be released November 15. To inquire about it, email us at Research@ChiefExecutiveGroup.com.