People shortages, high turnover rates and a deteriorating economy have America’s chief HR officers increasingly concerned according to our latest StrategicCHRO360 survey.

The Q2 survey, of 220 U.S. Chiefs of HR conducted May 17-20, shows ratings of future business conditions is now at 6.1 out of 10—measured on a 10-point scale where 10 is excellent—compared to 6.7 out of 10 in quarter one of this year. This quarter’s rating is down over 20 percent from their outlook this time last year. CHROs’ rating of current business conditions dipped only slightly this quarter, down 1 percent to 6.3 out of 10—14 percent below their rating of current conditions one year ago.

“Continued pressure/inflation on costs, and continued pressure on hiring practices, and meeting employees’ needs of remote/flexibility are the main elements driving my rating,” says the VP of HR at a energy/utility company.

Sue Johnson, Director of HR at Northeast Bank says, “The cost of living increasing so dramatically and the difficulty in finding good employees,” explains why she expects business conditions to drop to 6/10 rom 7/10 currently.

Other members of the C-suite concur. CEO forecasts of business conditions dropped 3 percent in May, after a 9 percent decline in April. Their rating of future business conditions now stands below that of CHROs—at 5.9/10.

CFOs’ prediction for future conditions also dropped in May, now at 6.2/10, down 6 percent from their prior rating. CIOs polled in May share the same rating as CFOs, which was an 11 percent drop from their previous rating of future business conditions in December.

A larger proportion of CHROs are now forecasting business conditions to worsen compared to last quarter, now at 38 percent compared to 21 percent in Q1 of 2022. They are becoming discouraged by inflation and labor scarcity, as well as growing fears of an incoming recession.

“Inflation, recession, and labor scarcity,” lists Paul Falcone, CHRO of Motion Picture and Television Fund, as the elements driving his “weak” or 4/10 forecast of future business conditions, down from 7/10 currently.

The CHRO of an agricultural company based in Arizona, says, “Global supply chain strains, excessive labor cost increases paired with US labor shortage, inflation, increased cost for access to capital dampen my forecast for the future.” She rates future business conditions 5/10 compared to her 7/10 rating of current conditions.

Talent is a main issue for executives across the board, with CEOs, CFOs and CIOs all mentioning talent struggles when voicing their concerns about future business conditions.

“The challenges to hiring, finding the right talent and meeting salary expectations are very concerning to our organization,” says the CHRO of an AI technology company to explain their rating of future conditions, which is down to 6/10 from their current rating of 8/10.

Despite the challenges many CHROs face, 29 percent of them predict that conditions will improve over the course of the next year. They say that today’s issues will work out as companies identify strategies to overcome talent shortages, inflation and supply chain constraints.

Donna Manion, VP of HR at GSP Retail, an industrial manufacturing firm, says, “Much depends on the economy and global concerns, but I believe conditions in the US will slowly improve. Covid will become part of daily work issues that HR leaders address and less a big interrupter.” She is hopeful that conditions will improve over the next year, up from 5/10 to 6/10, and elaborates, “Businesses are driving innovation at a fierce pace. If the inflation rate starts to come down, we could see improvements beyond expectations. But patience and resilience will be required to arrive at the new workplace.”

The proportion of CHROs forecasting improving business conditions does not stray far from the proportions of CEOs and CFOs who predict the same. In May 27 percent of CEOs forecasted improving conditions—unchanged from the month prior. The proportion of them forecasting worsening conditions declined from 50 percent in April to 46 percent in May—with a larger proportion forecasting conditions to remain unchanged.

As for the proportion of CFOs predicting worsening business conditions, that dramatically increased in Q2 to 48 percent, compared to only 30 percent in February. CIOs may be the most optimistic of the C-suite, with a plurality forecasting improving conditions—at 39 percent. Only 26 percent of CIOs forecast worsening conditions over the coming year.

The Year Ahead

The proportion of CHROs forecasting increases in profits and revenues over the course of the next 12 months both declined in Q2 of this year. Now. 65 percent of CHROs forecast increases in profits, down 9 percent from Q1. The proportion of CEOs forecasting the same dropped for the fifth consecutive month to 58 percent.

The proportion of CHROs expecting increases in revenues dropped by 10 percent in Q2 to 76 percent. This is in line with the proportion of CFOs who expect the same, at 75 percent. A smaller proportion of CEOs are forecasting increases in revenues, now at 70 percent, down for the fourth month in a row.

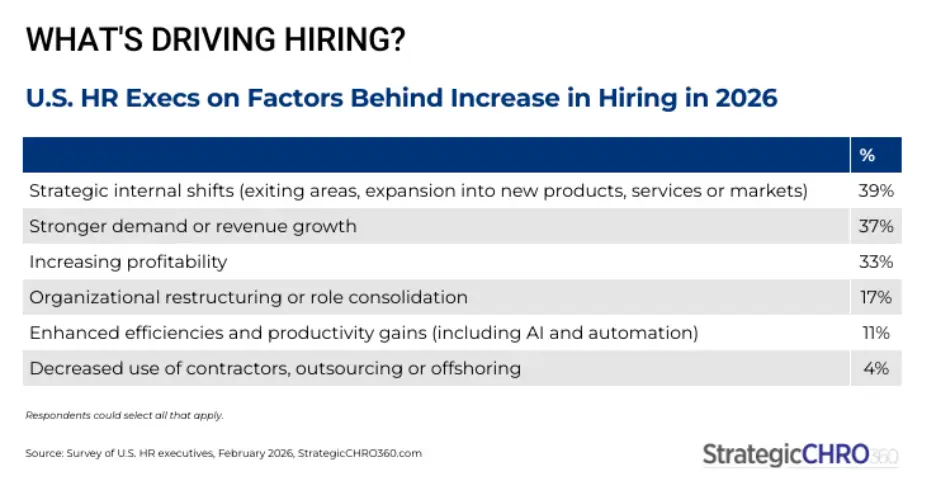

Sixty-five percent of CHROs are planning to add to their headcount over the next 12 months, the highest proportion of the C-suite—but down 9 percent from the proportion who forecasted the same in Q1.

The proportion of CEOs planning to increase hiring increased by 8 percent in May to 60 percent. This comes after two months of double digit drops in that same proportion.

About the CHRO Confidence Index

The CHRO Confidence Index is a pulse survey of U.S.-based CHROs and HR executives at organizations of all types and sizes on their perspective of the economy and how policies and current events are affecting their companies and strategies. Every quarter, StrategicCHRO360 partners with SHRM (the Society for Human Resource Management) to ask participating CHROs about their top issues and challenges for the months ahead. The results are published on StrategicCHRO360.com and a report is distributed to participants.